DueDash Investor Platform

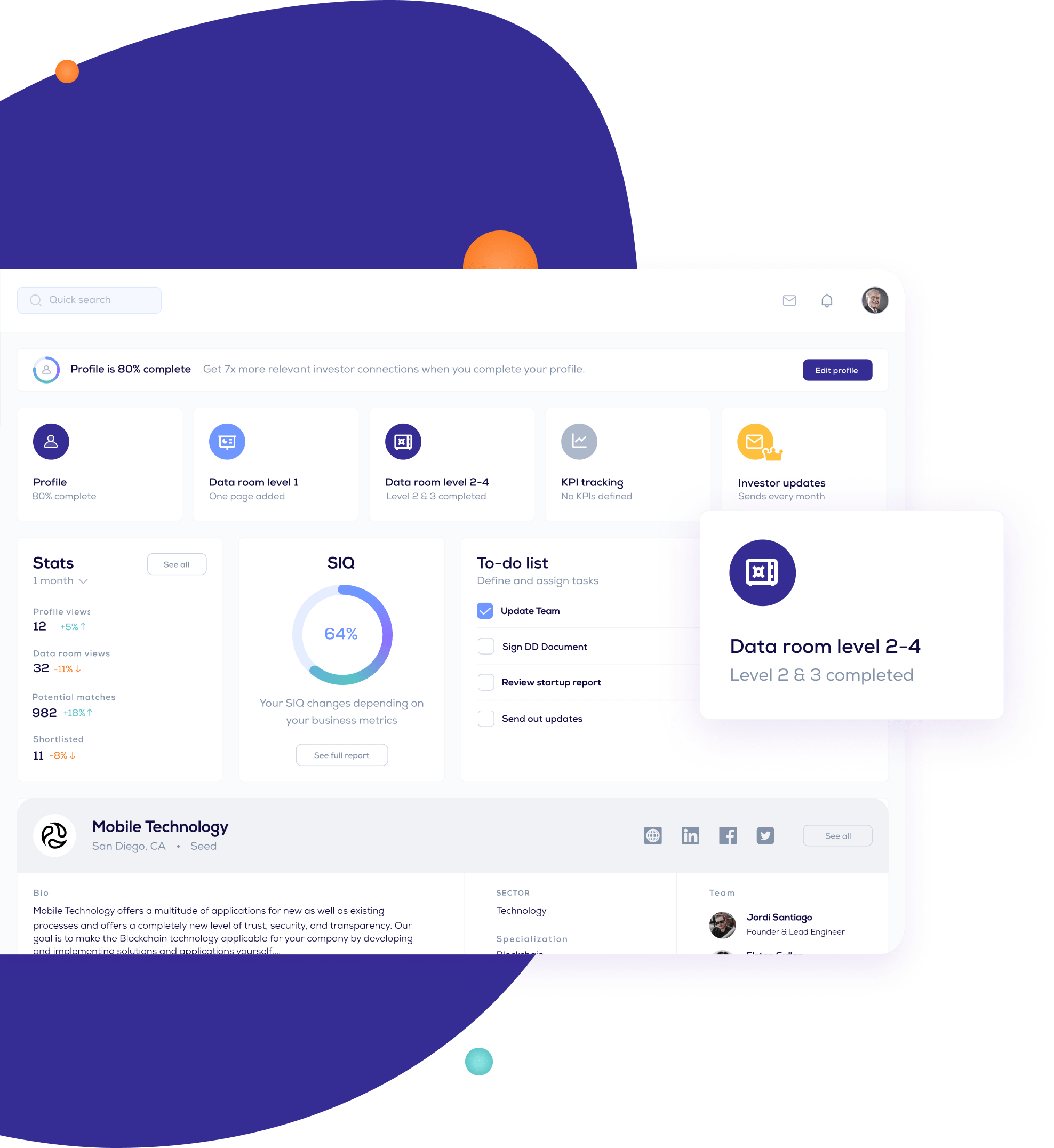

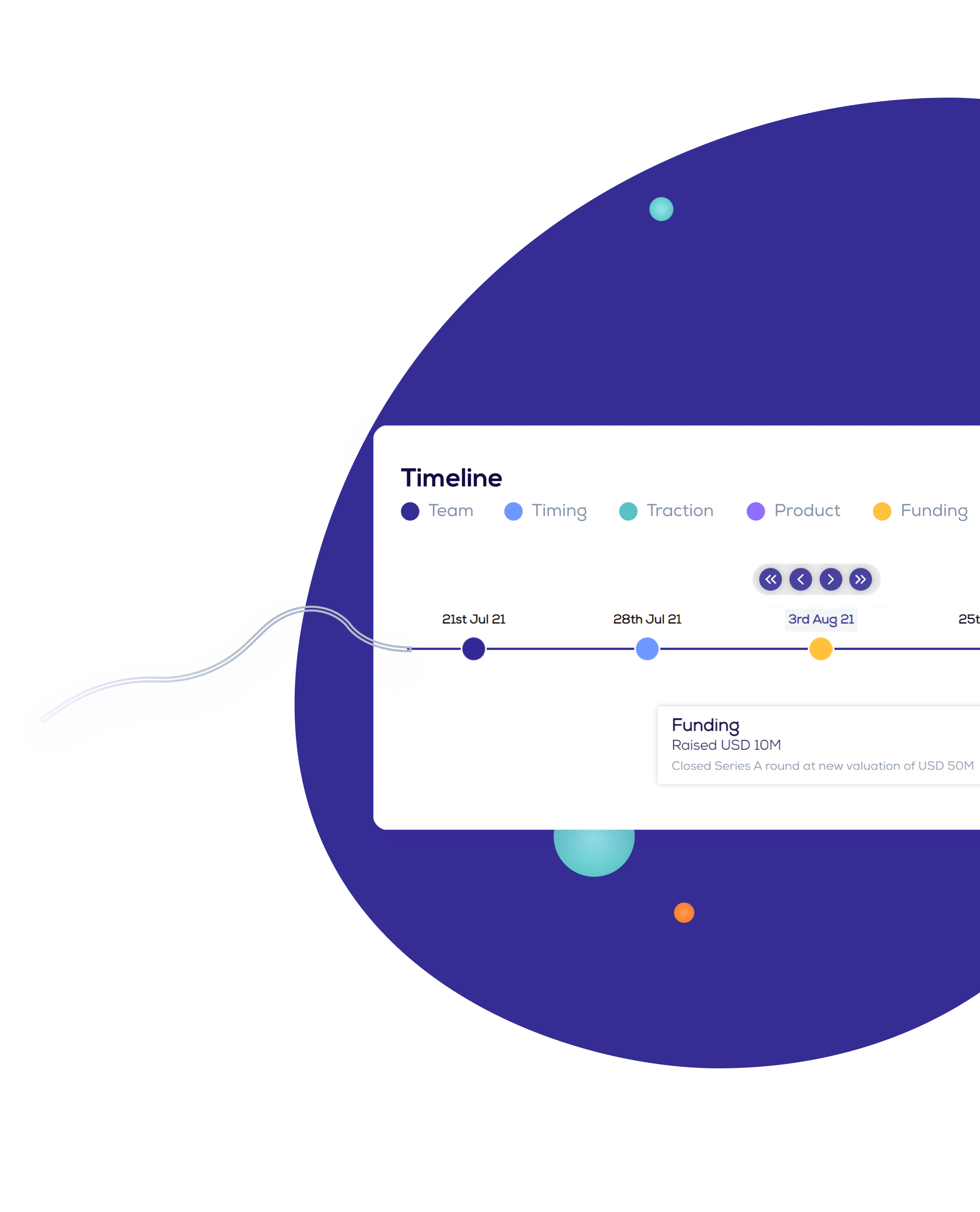

Data Collection Portfolio Tracking Investor Updates Startup Workflows Deal Flow Made Easy

Software that’s powerful, yet simple! Seamlessly unify data collection, evaluations, documents, updates, data rooms and reports on one simple platform that gives you actionable insights and saves you a ton of money.

No credit card required – 7-day free trial

5000+ users trust DueDash for managing their investor relations

What is DueDash?

DueDash is the game-changer in investor relations, elevating communication with data-rich updates and KPIs, aligning stakeholders and attracting new investors. Our software is your all-in-one solution, enriching the fundraising story with updates, charts, dashboards, and data rooms.

Experience automated portfolio tracking through our best-in-class workflow and synchronous monitoring, providing top-tier information effortlessly.

Tailored solutions await – Explore a demo from our premium software, or get started with our full suite of free tools and upgrade as needed.

Key benefits for investors

For most investments no other details of the deal matter if you don’t trust the counterparty. Trust is built by honest reporting of “the good, the bad and the ugly” to strengthen relationships.

Trust is key

Easily, help your startup founders understand the importance of consistent first person reporting for better outcomes.

Manage & showcase portfolio

Manage and keep track of your portfolio and showcase it to attract new deals & investors.

Collaborate with intent

With your investment firm members or your founders or other investors for co-investing, syndication, pipeline or data driven engagement.

Attract better deal flow

Attract and close a higher percentage of deals with actions which add to transparency, honesty and meaningful relationships.

Deal memos viewed

Data rooms accessed

Sectors

Investors

Startups who regularly update meaningfully are 3x more likely to raise capital or receive follow-on funding. No IRR, projected or current valuation or future exit potential means anything one cannot build trusted relations with investors.

Key benefits for startups

Update & build trust

Build trust through updates using simple and sophisticated update composer. Prepare once, share anywhere!

Metrics matter

Keep yourself on track and showcase your traction with KPIs and self diligence. Use SIQ scoring to identify your blind spots.

Fundraising CRM & Data Room

Manage your data room and existing and new investors / startups in your own pipeline and receive insights.

Seed new investors

Use your data story to come on the radar of potential investors both inside and outside the platform.

Testimonials

What our investors are saying

Hear from other investors, how the DueDash platform and custom services helped them across the entire investment life cycle.

Start your free 7-day trial today

Invite your team members and collaborate on data and relationship management with full-fledged functionality!

Key pillars

Your whole investor relations office in one platform

DueDash’s investor platform is built on four core pillars of data management, metrics/KPIs management, engagement and investor operations for meaningful relationship building. Each pillar is modular and is connected to the same underlying CRM database, providing you with insights at every stage of your fundraising process.

Data Hub

Manage data and get insights all from one platform to make informed decisions.

Main features

- Data management

- Data rooms

- Data analytics

Relationship Hub

Keep track of all exchanges and engagement and collaborate with your team.

Main features

- Investor CRM

- Messaging

- Notifications

Reporting Hub

Share and receive investor updates incl. regular KPI reporting with reminders.

Main features

- Contact management

- Metrics & Reporting

- Portfolio management

Features

DueDash is simple to use. But we even provide value beyond.

We have built an ecosystem to support founders and investors. Join our events, get newest investor alerts, industry news or access fundraising courses and investor roundtables.

Customer support

Have questions or need assistance? Let’s chat.

Onboarding guidance

Let’s get you started with DueDash and show you how to use it.

Education & Templates

Check our library of educational videos, courses & templates.

Blogs & news

Learn about exciting startups and industry news.

Deals & credits

Create your data room or access deals to grow your business.

Events & roundtables

Join open or closed events with investors and experts.